| Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |||

March [•], 20237, 2024

Dear Fellow Goodyear Shareholder,

ThankIt is my privilege to serve as Chairman of Goodyear’s Board of Directors. Our commitment to our shareholders, as always, is to oversee the Company and steer it in a direction that positions it for long-term success and reflects your interests. From that perspective, I am pleased to share with you what we view as highlights of Goodyear’s progress in 2023, an eventful and change-filled year that I’m confident will be remembered as one in which we charted a new course designed to create sustainable value.

GOODYEAR FORWARD AND NEW DIRECTORS

In July, the Board announced a robust review of Goodyear’s business, led by our Strategic and Operational Review Committee. Over a 16-week period, the Committee conducted a comprehensive evaluation of various alternatives and opportunities to maximize shareholder value creation, with support and approval from the full Board. In November, we announced the result of this review: our Goodyear Forward transformation plan. Goodyear Forward provides a clear path to a more focused and profitable Goodyear through three key pillars: optimizing our portfolio, delivering significant margin expansion and reducing leverage. Our Board and executive team are prepared to execute this plan and deliver value for yourour shareholders.

Also in July, we welcomed three new directors to our board: Joe Hinrichs, Max Mitchell and Roger Wood. Each of them brings fresh perspective to the Board, while also contributing decades of manufacturing industry and strategic expertise. Max and Roger served on our Strategic and Operational Review Committee, and all three new directors were integral in the formation of our Goodyear Forward plan.

CEO TRANSITION

In November, Goodyear shared Rich Kramer’s plans to retire as Chairman, CEO and President after 14 years of service in that role, and 24 years with the Company. The Board is deeply grateful for Rich’s 14 years of service as CEO and for his outstanding leadership and innumerable contributions to Goodyear over the course of his distinguished career, including leading the development of our Goodyear Forward plan.

As part of the Board’s ongoing and active succession planning process, the Board conducted an extensive search, which considered both internal and external candidates for the CEO role. In January,

following Rich’s retirement, Mark Stewart became Goodyear’s CEO and President. Mark joins Goodyear from Stellantis, a leading global automaker and provider of innovative mobility solutions, where he served as COO of North America and a member of the Group Executive Council. The Board has tremendous confidence in Mark as the right CEO to lead the Company and carry out the Goodyear Forward plan. Already he is making a significant impact on the organization and the Board is excited about the successes his leadership will bring to Goodyear.

SHAREHOLDER ENGAGEMENT

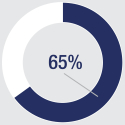

Throughout 2023, the Board continued investmentto solicit and consider the perspectives of our shareholders as one of the most valuable inputs in Goodyear. how we oversee the business. Goodyear continued its shareholder engagement program, ultimately meeting with shareholders representing 65% of outstanding shares held by institutional investors. I and other members of the Board participated in some of these calls with our largest investors. Feedback we received from these engagements was key in our strategic and operational review and is critical in informing the Board’s decision-making processes. We have heard strong support from our shareholders for our Goodyear Forward plan.

I hope you will join our 2024 Annual Meeting of Shareholders, which will be held on April 8, 2024 at the Sheraton Suites Akron/Cuyahoga Falls.

On behalf of the Board, of Directors, I am pleased to invite you to attend the 2023 Annual Meeting of Shareholders.

Our business made significant progresswe appreciate your investment and support in 2022 amid a very challenging operating environment marked by record levels of inflation, supply challenges and softening economic growth globally. Despite this backdrop, Goodyear grew share in both replacement and OE markets, backed by new fitment wins, innovative new products, our advantaged supply chain and leading customer service.

At the same time, we captured the value of our brands in the marketplace, achieving a record level of price/mix. We also continued to execute on plant optimization and structural cost initiatives throughout our operations in the face of continued inflationary pressures. While some of these necessary actions are difficult, I am confident they will set us up for future success.

Our teams also made great progress on the combination of Goodyear, and Cooper. With much of the work to integrate the two companies completed during 2022, we are well-positioned to capture the full value of this historic combination in 2023 and beyond. We remain focused on further integrating our brand and product portfolios to benefit our customers and consumers, while driving efficiency in our operations.

During 2022, we also continued to demonstrate why we are a leader at the forefront of new mobility. This is evident in our industry-leading commercial fleet services like Goodyear Sightline, as well as our new business models like our direct-to-consumer mobile van service and AndGo, our predictive vehicle servicing platform.

Through these innovations, we are forging new partnerships and achieving new milestones as we shape the future of mobility. One instance of this is a first for our industry: demonstrated capability to accurately estimate tire-road friction potential and provide real-time information to maximize uptime through our partnership with Gatik, a leader in autonomous middle mile logistics.

While these and other innovations are adding value for customers and helping us win in the marketplace today, we are also focused on

operating in ways that will benefit generations to come. Goodyear recently unveiled a demonstration tire made of 90% sustainable materials – a significant step toward our goal of creating the industry’s first 100% sustainable-material tire by 2030. We plan to distinguish ourselves further by offering an up to 70% sustainable-material tire for sale to consumers in the U.S. in 2023.

Goodyear also continues to make progress toward its other sustainability targets, including our goal of reducing Scope 1 and 2 emissions by 46% and certain Scope 3 emissions by 28% by 2030, aligned with the Science-Based Targets initiative (SBTi) and its Net-Zero standard. To this end, our operations in Europe achieved 100% renewable electricity by the end of 2022, fulfilling the goal set out in 2021.

Our ability to execute remains strong despite the challenges the larger world is facing. We are growing share, capturing the value of our brands and realizing the value of our largest-ever acquisition. We also remain undeterred as we help enable mobility and contribute meaningfully to create a better future for the world in which we live.

I am extremely proud of what our teams delivered in 2022. In doing so, they demonstrated resilience in the face of adversity – a defining characteristic for our 125-year-old company.

On behalf of our Board of Directors, thank you for your continued support. We look forward to welcoming you at our annual meeting.

Sincerely,continuing to serve on your behalf.

|

| |

Chairman of the Board

|

March [•], 20237, 2024

Dear Fellow Goodyear Shareholder,

It is truly an honor to join Goodyear as its Chief Executive Officer and President. I recognize what a privilege it is to lead this iconic global company with its unmatched brand and industry-leading innovation, especially during this pivotal time in its history. I had great expectations coming into this role, and everything I am learning makes me even more excited about Goodyear’s potential.

Leaders and associates throughout Goodyear have already made significant progress in implementing Goodyear Forward, our strategic transformation plan initiated under the leadership of our former CEO Rich Kramer and the Board’s Strategic and Operational Review Committee. I am grateful to serve asRich for his leadership in developing the plan and driving early execution, and I am pleased to carry on that work, with the goals of strengthening Goodyear’s independent Lead Director. As a Board, we remain steadfastlyfoundation and delivering sustainable shareholder value creation. I want you to know that I am committed to representing your interests by providing robust independent oversightGoodyear Forward and delivering on Goodyear’s strategic priorities. It’s my pleasure to provide you an update on some of the key areas on which we have focused as a Board over the last year.

BOARD OVERSIGHT OF STRATEGY AND PERFORMANCE

Our Board of Directorsconfident it is composed of committed, qualified and diverse individuals who provide a wealth of experience and expertise directly relevant to Goodyear’s business. We remain focused on ensuring we have the right skillsets on the Board to oversee the execution of Goodyear’s strategy. To that end, we are pleased to welcome Norma Clayton, formerly of The Boeing Company and currently the Chair of the Board of Trustees of Tuskegee University, as a new independent Director since our last annual shareholder meeting. Norma’s leadership experience in manufacturing, operations, technology, innovation and human resources will be invaluable tostrategy for Goodyear and its shareholders as we build our businessunlock new opportunities for growth and fulfill our role of enabling mobilitypave the way for the Company’s enduring success.

Consistent with this commitment, since I joined in a fast-evolving industry.

We are proud of Goodyear’s performance in 2022, particularly given the challenges that weearly January, I have faced due to the war in Ukraine and the resulting impact on the European economy, global inflation, and the ongoing effects of the COVID-19 pandemic in some regions.

RESPONSIVENESS TO SHAREHOLDER CONCERNS

The Board was disappointed with our say-on-pay vote outcome in 2022 and has been focused on developing a deep understanding of Goodyear: meeting with our associates, visiting our factories and respondinggetting to know our customers. I’m engaging in deep dives on each element of the shareholder feedback we received related to that vote. Through our engagement efforts that were ledGoodyear Forward plan and its associated workstreams.

In the short time since I joined Goodyear, I have been thoroughly impressed by the Chairmantalented team of our Human Capitalassociates who are enabling mobility around the world. I’m grateful for all their drive and Compensation Committee,teamwork as we sought to elicit and consider shareholders’ perspectives related to our executive compensation program. The Compensation Committee, of which I am a member, has carefully considered and adopted a number of specific actions suggested by our shareholders in order to respond to the say-on-pay vote and align our executive compensation program with shareholder expectations and shareholder value creation. Those actions, including changes to our long-term incentive plan design and

enhancements in our proxy disclosure, are described in our Compensation Discussion and Analysis in this Proxy Statement.

In addition to discussing our executive compensation programs, we appreciated the opportunity to discuss with shareholders Goodyear’s strategy, operations, governance practices, and environmental and sustainability initiatives.

On behalf of the Board, I want to thank Goodyear’s investors for regularly engaging withposition the Company for long-term success. Their dedication is another reason I believe that we are on the right track to meaningfully enhance Goodyear’s capabilities and sharing valuable perspectives on how we can continue to improve our executive compensation program. The feedback we receive from shareholders is reported to the full Board and is vital to our decision-making process.

SUCCESSION PLANNING

One of the Board’s core responsibilities is the selection and retention of, and succession planningcost effectiveness for the chief executive officer and other members of management. The Board regularly discusses and reviews management succession plans, both with the chief executive officer and in executive session. I am particularly pleased this year to see some of the fruits of those efforts with the election of Christina Zamarro as Executive Vice President and Chief Financial Officer and Darren Wells as Executive Vice President and Chief Administrative Officer, a newly created position overseeing Goodyear’s strategy and growth initiatives. We have included a further update on our succession planning practices in the section titled “Management Succession Planning.”long term.

I appreciate your confidence and support as we continue this journey, and I look forward to meeting with our investors as part of my learning process and on an ongoing confidencebasis. We will update you regularly on our progress and ensure that investor perspective is properly reflected it in Goodyear and the Board of Directors, and thank you for your continued investment. We remain committedour decision-making. I look forward to serving your interests, and we appreciate the opportunity to serve Goodyear on your behalf.

Sincerely,our future collaboration.

| Sincerely, | |

|

|

NOTICE OF 20232024 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT

To the shareholders:

The

| Location:

Sheraton Suites Akron/Cuyahoga Falls 1989 Front Street Cuyahoga Falls, Ohio 44221

Time & Date:

Monday, April Eastern Time

The Board of Directors fixed the close of business on February

If you are not able to attend, we hope that you will vote by proxy. These proxy materials contain detailed information about the matters on which we are asking you to vote. Please read the materials, including the Board’s recommendation on each Proposal, thoroughly. Your vote is very important to us.

March By order of the Board of Directors

Daniel T. Young, Secretary |

Please vote via the internet or by telephone or complete, date and sign your Proxy and return it promptly in the enclosed envelope

|

| ||||||||

|

PROXY STATEMENT SUMMARY

This summary is an overview of information that you will find elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. This proxy statement and the form of proxy are first being sent to shareholders on or about March 13, 2023.7, 2024.

Proposals and Board Recommendations

| Proposal | Proposal | Board’s Voting Recommendation | Page Reference | Proposal | Board’s Voting Recommendation | Page Reference | ||||||||||

1. | Election of Directors | FOR each Nominee | 15 | Election of Directors | FOR each Nominee | 16 | ||||||||||

2. | Advisory Vote on Executive Compensation | FOR | 22 | |||||||||||||

2. | Advisory Vote on Executive Compensation | FOR | 23 | |||||||||||||

3. | Advisory Vote on Say-On-Pay Frequency | ONE YEAR | 23 | |||||||||||||

4. | Ratification of Appointment of Independent Registered Public Accounting Firm | FOR | 91 | |||||||||||||

5. | Company Proposal with respect to amending the Company’s Articles to eliminate statutory supermajority vote requirements applicable to our common stock | FOR | 93 | |||||||||||||

6. | Shareholder Proposal regarding Shareholder Ratification of Excessive Termination Pay | AGAINST | 95 | |||||||||||||

3. | Ratification of Appointment of Independent Registered Public Accounting Firm | FOR | 89 | |||||||||||||

Business Overview

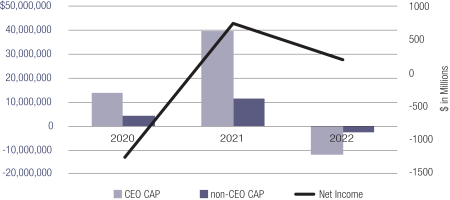

Goodyear is one of the world’s leading manufacturers of tires, engaging in operations in most regions of the world. In 2022, our net sales were $20,805 million and Goodyear net income was $202 million. We develop, manufacture, distribute and sell tires for most applications through our strong portfolio of brands, led by the Goodyear brand, one of the most recognizable brand names in the world, as well as the Cooper, Dunlop, Kelly, Mastercraft, Roadmaster, Debica, Sava and Fulda brands.

We are one of the world’s largest operators of commercial truck service and tire retreading centers. We operate approximately 950 retail outlets where we offer our products for sale to consumer and commercial customers and provide repair and other services. We have a pervasive distribution network that is focused on making the tire buying process easier — with a concentrated network of aligned third-party distributors, approximately 300 warehouse distribution facilities, and a leading business-to-consumere-commerce platform.

We manufacture our products in 57 manufacturing facilities in 23 countries, including the United States, and we have marketing operations in almost every country around the world. We employ approximately 74,000 full-time and temporary associates worldwide.

Business Overview Goodyear is one of the world’s leading manufacturers of tires, engaging in operations in most regions of the world. In 2023, our net sales were $20,066 million and Goodyear net loss was $689 million. We develop, manufacture, distribute and sell tires for most applications through our strong portfolio of brands, led by the Goodyear brand, one of the most recognizable brand names in the world, as well as the Cooper, Dunlop, Kelly, Mastercraft, Roadmaster, Debica, Sava and Fulda brands. We are one of the world’s largest operators of commercial truck service and tire retreading centers. We operate approximately 950 retail outlets where we offer our products for sale to consumer and commercial customers and provide repair and other services. We have a pervasive distribution network that is focused on making the tire buying process easier — with a concentrated network of aligned third-party distributors, approximately 300 warehouse distribution facilities, and a leading business-to-consumere-commerce platform. We manufacture our products in 55 manufacturing facilities in 22 countries, including the United States, and we have marketing operations in almost every country around the world. We employ approximately 71,000 full-time and temporary associates worldwide. |

| i |

| ||||||||

| PROXY SUMMARY

|

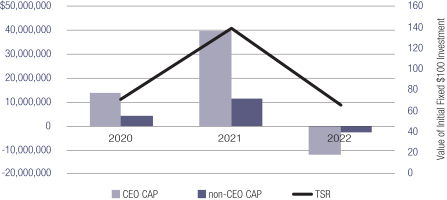

20222023 Year in Review

Operating results in 2023 included significant sequential margin expansion on improving costs, despite a persistently weak volume environment across both consumer and commercial replacement markets.

The replacement tire industry was down 1% in 2023, with the weakest segments being U.S. and European commercial replacement given lower freight demand and consumer replacement in Europe, Middle East and Africa (“EMEA”) generally. Despite these developments, Goodyear maintained its leading position in the U.S. replacement market and remains a challenging operating environmentleader in 2022,other key markets throughout the globe. Goodyear grew market share and delivered stable earningsalso continued to perform well at original equipment (OE) with our win rate on robust revenue growth.new electric vehicle (EV) fitments remaining strong.

Thanks toWhile the combination with Cooper Tire & Rubber Company (“Cooper Tire”), along with a slate of innovative new products and our advantaged supply chain, we grew tire volumes more than the industry during 2022. We delivered replacement volume growth of 7% against an industry that declined 2%. We also grew OE volumes 15% against an industry that grew 5%, reflecting continued industry recovery and new fitment wins. During 2022, we won 60 percentfirst half of the fitments we sought and nearly tripled our wins on electric vehicle fitments versus 2021.

In the face of significant inflationary cost pressures, we captured the value of our brands in the marketplace, reflected in strong revenue per tire growth of approximately 16% (before the effects of foreign currency). In addition to driving the top line higher, price/mix benefitted earningsyear was impacted by $2.5 billion — a company record, which more than offset $1.9 billion of higher raw material costs and most of the $0.9 billion of inflationary and other cost increases.

In response to ongoing cost pressures, we took actions to manage our cost structure. In addition to pursuing ongoing operational productivity initiatives, which are even more valuable givencosts, improving trends during the effects of inflation, we also commenced a series of structural cost savings programs to help our businesses match the reality of the current environment. Expected to benefit 2023 and beyond, these programs include the announced closureyear enabled significant margin expansion. These trends culminated in double-digit segment operating margins in two of our facility in Melksham, UK,regions by the fourth quarter, including Americas where segment operating income margin was the highest quarterly result since 2021. Improved earnings and reduced working capital to exit of our South African retail operations, and a rationalization and reorganization of our global salaried workforce.2023 contributed to the strongest quarterly operating cash flow since before the pandemic.

AsLooking ahead, we executed well in the face of an uncertain and volatile environment, we continuedbegan to lay the groundworkfoundation for future earnings growth while making progress to help shapethe next stages of our growth. The formation of a better future through our sustainability initiatives.

We made meaningful progress onBoard-led strategic and operational review culminated in the integrationcreation of Cooper Tire, ensuring the combination’s promised value and putting us on track to achieve the targeted run-rate synergies by mid-2023.

We continued to demonstrate why we are a leader at the forefront of new mobility trends, where we are helping shape the intelligent tire. In one example, we demonstrated capability to accurately estimate tire-road friction potential and provide real-time information to maximize uptime through our partnership with Gatik, a leader in autonomous middle mile logistics.

Meanwhile, we continued to make progresstwo-year transformation plan called Goodyear Forward. Building on our bold sustainability goals. Among thesestrengths, the plan is focused on optimizing our recently unveiled demonstration tire comprisedportfolio, delivering significant margin expansion and reducing leverage to drive sustainable and substantial shareholder value creation. During 2023, we began to drive the execution of 90% sustainable materials — a significant step toward our goal of creating the industry’s first 100% sustainable-material tire.that plan, which is expected to begin delivering value throughout 2024.

| ii |

| ||||||||

| PROXY SUMMARY

|

Relative Performance

Our market share in key consumer replacement tire markets, global consumer original equipment tires, and key commercial replacement tire markets all rose in 2022 when compared to 2021.

| Share of Market | 2021 | 2022 | ||||||

Consumer Replacement - Key Markets | 12.2 | % | 15.4 | % | ||||

Consumer OE - Global | 8.9 | % | 10.1 | % | ||||

Commercial Replacement - Key Markets | 8.8 | % | 10.1 | % | ||||

Shareholder Engagement and Responsiveness

We believe that it is important for us to communicate regularly with shareholders regarding areas of interest or concern. We have a robust shareholder engagement program that includes an annual outreach that is focused on our long-term business strategy, executive compensation, corporate governance, corporate responsibility and other topics suggested by our shareholders. Our annual outreach helps to ensure that our shareholders are heard and able to communicate directly with us on these important matters.

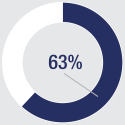

As part of our annual outreach (based on our outstanding common stockCommon Stock as of December 31, 2022)September 30, 2023):

| We requested the opportunity to meet with shareholders representing 80% of outstanding shares held by institutional investors. |   | We engaged with shareholders representing |

Our outreach this year gave us an opportunity to discuss:

| • | The work of the Board’s Strategic and Operational Review Committee and the development of the Goodyear Forward transformation plan; |

| • | Management succession planning activities, Board refreshment and composition, and other corporate governance matters; |

| • | Executive compensation, including investor feedback on recent changes to our |

| • | Our sustainability initiatives and disclosures, including the validation of our |

|

|

|

|

| iii |

| ||||||||

| PROXY SUMMARY

|

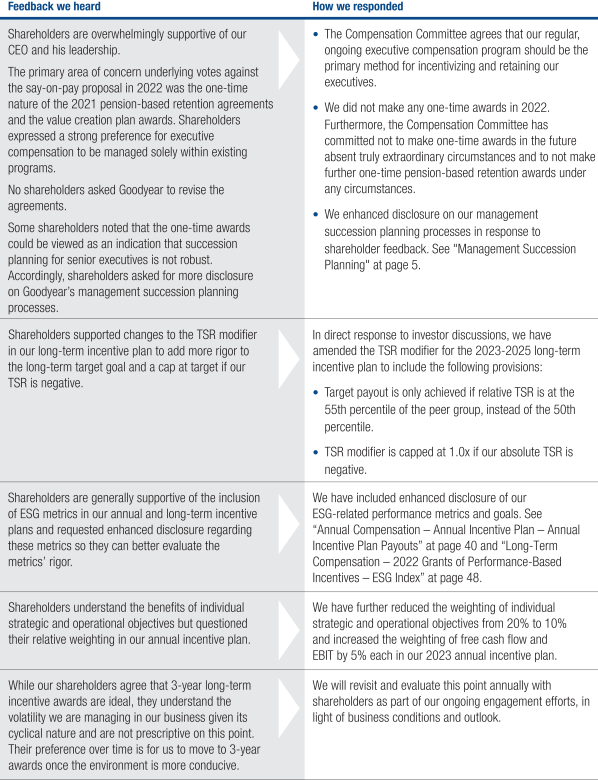

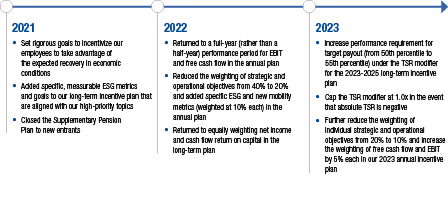

RESPONSE TO 2022 SAY-ON-PAY VOTE

At the 2022 annual meeting, our say-on-pay vote was approved by 21% of our shareholders. The Human Capital and Compensation Committee (the “Compensation Committee”) and entire Board were disappointed with this outcome and have been focused on understanding and responding to our shareholders’ feedback reflected in this vote. Through our engagement efforts, we sought to elicit and consider shareholders’ perspectives related to our executive compensation program, program design elements and specific actions to inform appropriate responses to the say-on-pay vote.

During these engagements, we continued to receive positive feedback on our balanced metrics in the 2022 annual and long-term incentive plans, and shareholders did not have concerns with the fundamental aspects of our compensation program’s design. Instead, shareholders who voted against say-on-pay in 2022 noted specific compensation actions taken during 2021 as the driver of their vote. These actions were not repeated in 2022, and the Compensation Committee made commitments to not repeat these actions in the future except in truly extraordinary circumstances. Furthermore, other changes were implemented to our program, informed by feedback we received from our shareholders.

Our Compensation Discussion and Analysis, beginning on page 27, provides a discussion of the areas of concern that these shareholders expressed and the actions the Compensation Committee has taken in response. All of the shareholders that we spoke with indicated that these actions were appropriate and acceptable resolutions to the low say-on-pay vote in 2022.

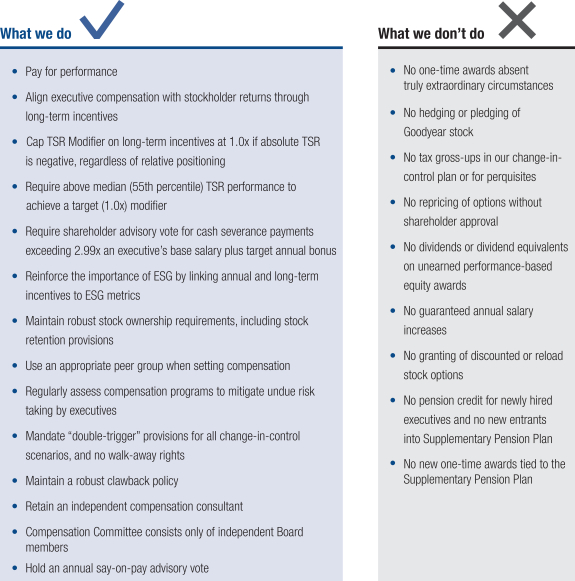

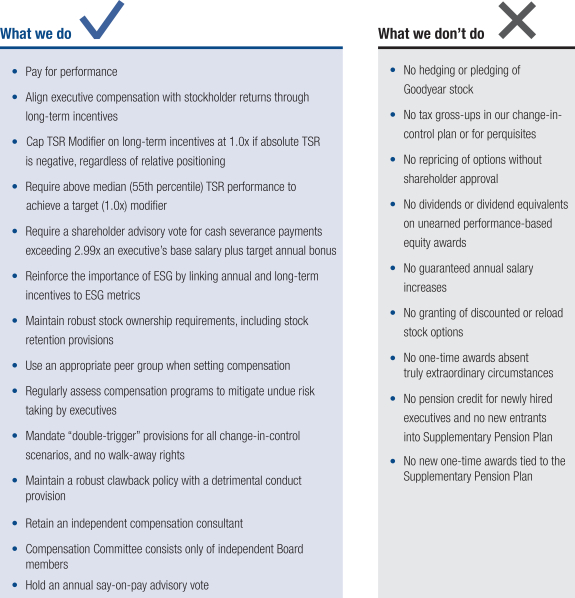

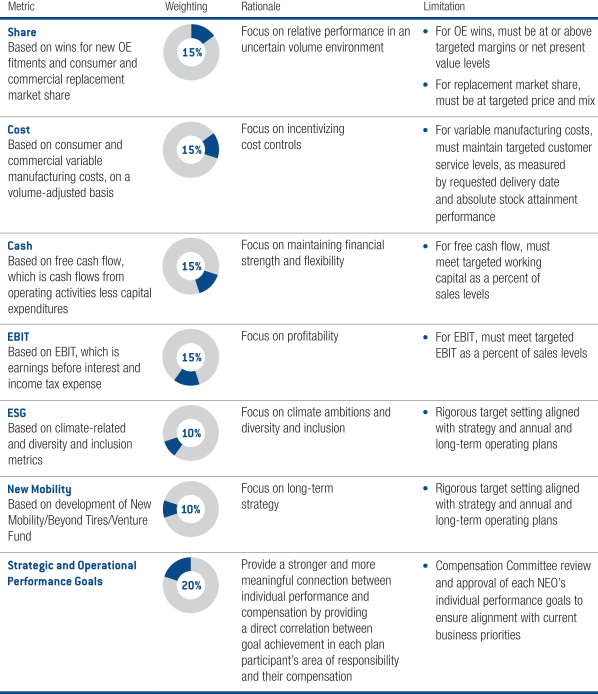

Executive Compensation Highlights

Our executive compensation program is designed to support achievement of our business objectives and to serve the long-term interests of our shareholders and is strongly aligned to Company performance and measurable financial and other metrics, thereby aligning management’s interests with our shareholders’ interests by focusing management on driving increased shareholder value. Our financial and other metrics also continue to be aligned with our strategic objectives, as shown in the table below.

| Strategic Objective | Metric | |

| Competitive Advantage | Market Share and Variable Manufacturing Cost | |

| Profitability | EBIT, | |

| Strong Liquidity | Free Cash Flow | |

| Return Generated on Investments in Business | Cash Flow Return on Capital | |

| Superior Shareholder Returns | Relative TSR Modifier | |

| New Mobility | New Mobility Goals | |

| Corporate Responsibility and Sustainability | ESG | |

| Specific Drivers of Success of Business | Individual Strategic | |

| iv |

| ||||||||

| PROXY SUMMARY

|

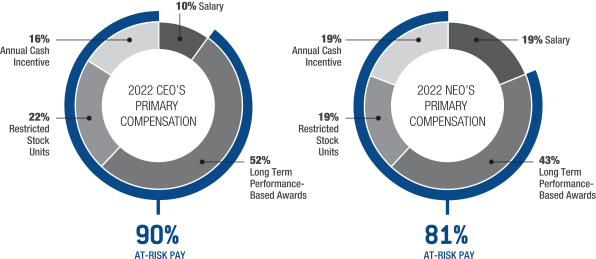

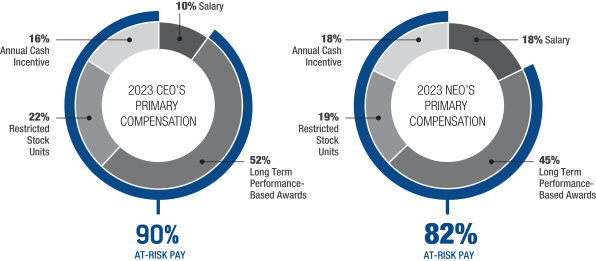

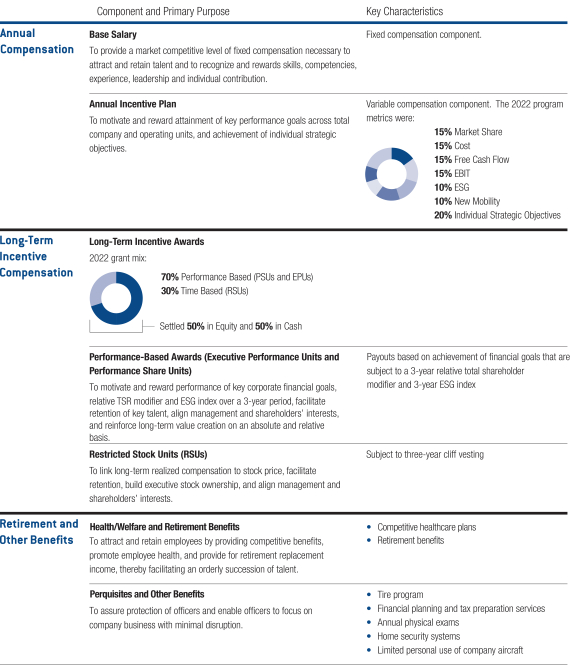

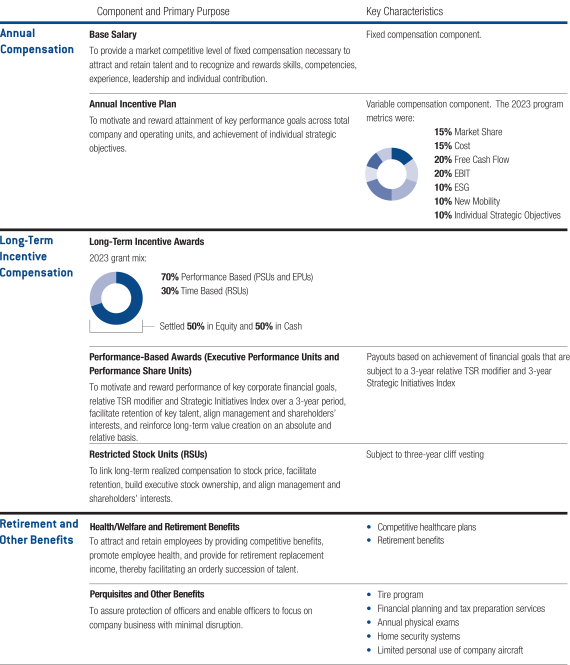

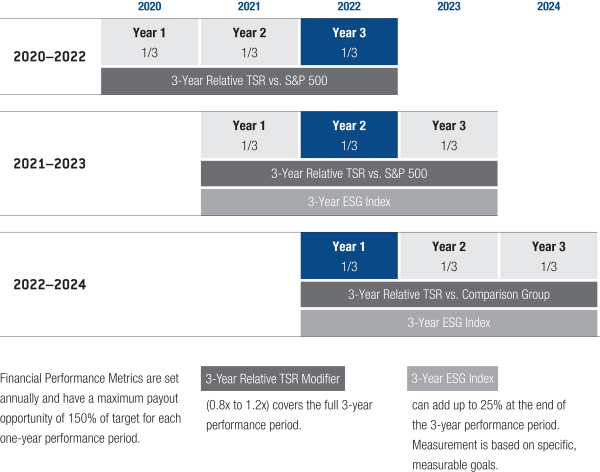

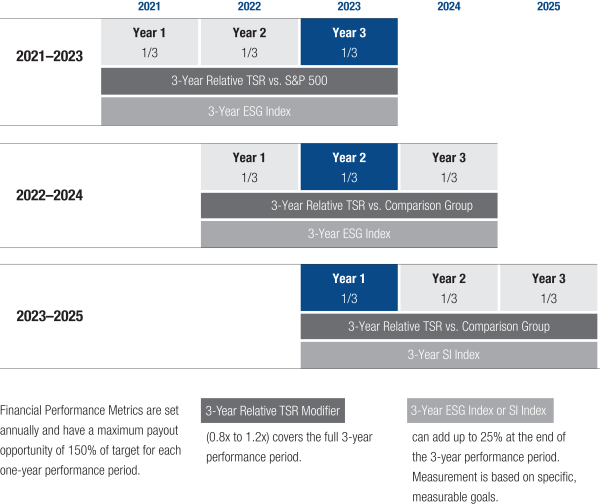

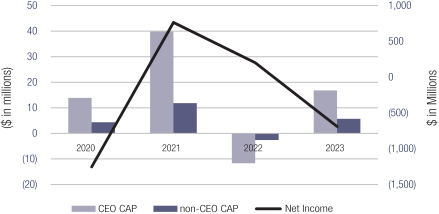

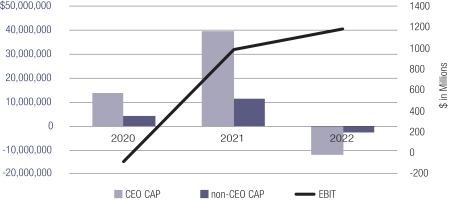

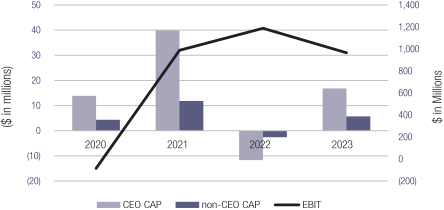

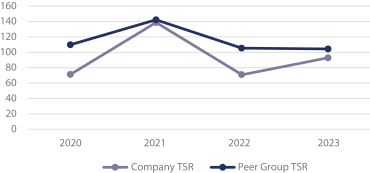

The resulting compensation for our named executive officers is comprised of a mix of variable and fixed compensation that is strongly linked to our performance. For 2022,2023, our compensation metrics were:

Incentive Program

| Metrics

|

| Weighting

|

| |||||||||||||||||||||

ANNUAL INCENTIVES | Annual Incentive Plan | Market Share |

| 15% |

| ||||||||||||||||||||

Cost |

| 15% |

| ||||||||||||||||||||||

Free Cash Flow |

|

|

| ||||||||||||||||||||||

EBIT |

|

|

| ||||||||||||||||||||||

New Mobility |

| 10% |

| ||||||||||||||||||||||

Environmental, Social and Governance (ESG) |

| 10% |

| ||||||||||||||||||||||

Individual Strategic |

|

|

| ||||||||||||||||||||||

| LONG-TERM AWARDS |

| ||||||||||||||||||||||||||||

Performance-Based Awards (Paid out in Equity and Cash)

| Net Income

|

| 50% |

|

| ||||||||||||||||||||||||

Cash Flow Return on Capital

|

|

50%

|

| ||||||||||||||||||||||||||

| +0-25 | % | ||||||||||||||||||||||||||||

• Reduction in Greenhouse Gas Emissions • |

| ||||||||||||||||||||||||||||

Restricted Stock Units | Three-year cliff vesting | ||||||||||||||||||||||||||||

Director Nominees

Our well-qualified and diverse group of directors brings an important mix of leadership, boardroom and operating experience to Goodyear. Our directors provide us with critical insights on many important issues facing our business. These collective attributes enable the Board to exercise appropriate independent oversight of management and pursue long-term, sustainable shareholder value creation by providing strategic input on the development and oversight of the implementation of our long-term strategy.

Our Board seeks to have well-balanced tenures, with longer serving directors who provide knowledge of our business through industry cycles and newer directors with fresh perspectives. During 2023, following an extensive and thoughtful search process, we added three new directors to our Board. Our new directors, Joseph Hinrichs, Max Mitchell and Roger Wood, bring extensive industry experience, deep expertise in driving corporate strategy and optimizing results, and a commitment to building excellence through investment in people and culture.

Consistent with our Corporate Governance Guidelines, the Governance Committee seeks nominees who will provide a diversity of perspectives in Board deliberations, as well as diversity in personal characteristics, such as age, gender and ethnicity. While the Board has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees, the Governance Committee and the Board believe that considering diversity is consistent with the goal of creating a Board that best serves the needs of the Company and the interests of its shareholders, and it is one of the many factors that they consider when identifying individuals for Board membership.

| v |

| ||||||||

| PROXY SUMMARY

|

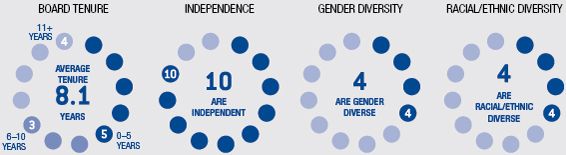

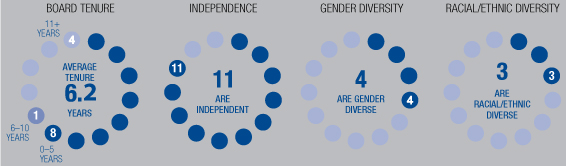

The composition of the nominees for election to the Board at the 20232024 Annual Meeting is reflected below. See Proposal 1 for additional details.

Corporate Governance Highlights

WE HAVE AN ABIDING COMMITMENT TO GOOD GOVERNANCE, AS ILLUSTRATED BY THE FOLLOWING PRACTICES:

| ||||

• Annually elected directors; no classified board

• Majority voting for the election of directors with a resignation policy

•

• 100% independent audit, compensation and nominating committees

• Regular executive sessions of the independent directors

• Conduct annual Board and Committee evaluations | • Proxy access available to 3 year, 3% shareholders for up to 20% of Board

| • Overboarding policy in place for directors

• No poison pill in place

• Shareholders have the right to call a special meeting at 25%

• Robust claw-back policy for accounting restatements and detrimental conduct • Clear and robust corporate governance guidelines

• Maintain a leading corporate responsibility program with Board oversight | ||

| vi |

|

TABLE OF CONTENTS

USE OF FORWARD-LOOKING STATEMENTS

For additional information regarding our use of forward-looking statements in this Proxy Statement, see Exhibit A.

|

CORPORATE GOVERNANCE

PRINCIPLES AND BOARD MATTERS

Goodyear is committed to having sound corporate governance principles. Having such principles is essential to running Goodyear’s business efficiently and to maintaining Goodyear’s integrity in the marketplace. Goodyear’s Corporate Governance Guidelines, Business Conduct Manual, Board of Directors and Executive Officers Conflict of Interest Policy and charters for each of the Audit, Human Capital and Compensation, Corporate Responsibility and Compliance, Finance, and Governance Committees are available at https://corporate.goodyear.com/us/en/investors/governance/documents-charters.html. Please note, however, that information contained on the website is not incorporated by reference in this Proxy Statement or considered to be a part of this document. A copy of the committee charters and corporate governance policies may also be obtained upon request to the Goodyear Investor Relations Department.

CURRENT COMMITTEE MEMBERSHIP AND MEETINGS HELD DURING 20222023

| Committees | Committees | |||||||||||||||||||||||||||||||

|

| Independent | Audit | Human Compensation | Corporate & Compliance | Finance | Governance | Executive | Independent | Audit | Human Compensation | Corporate & Compliance | Finance | Governance | Strategic & Operational Review | Executive | |||||||||||||||||

Ms. Clayton |

| MEMBER | MEMBER |

| MEMBER | MEMBER | ||||||||||||||||||||||||||

Mr. Firestone |

| CHAIR | MEMBER | MEMBER |

| CHAIR | MEMBER | MEMBER | MEMBER | |||||||||||||||||||||||

Mr. Geissler |

| MEMBER | MEMBER |

| MEMBER | MEMBER | ||||||||||||||||||||||||||

Ms. Koellner, Lead Director |

| MEMBER | MEMBER | CHAIR | ||||||||||||||||||||||||||||

Mr. Hinrichs |

| MEMBER | MEMBER | |||||||||||||||||||||||||||||

Mr. Kramer, Chairman and CEO | MEMBER | |||||||||||||||||||||||||||||||

Ms. Koellner, Chairman1 |

| MEMBER | MEMBER | CHAIR | ||||||||||||||||||||||||||||

Mr. Kramer, Former Chairman and CEO1 | CHAIR | MEMBER | ||||||||||||||||||||||||||||||

Ms. Lewis |

| CHAIR | MEMBER | MEMBER |

| CHAIR | MEMBER | MEMBER | ||||||||||||||||||||||||

Mr. Mahendra-Rajah |

| MEMBER | MEMBER |

| MEMBER | MEMBER | ||||||||||||||||||||||||||

Mr. McGlade |

| CHAIR | MEMBER | MEMBER |

| CHAIR | MEMBER | MEMBER | ||||||||||||||||||||||||

Mr. Mitchell |

| MEMBER | MEMBER | |||||||||||||||||||||||||||||

Mr. Palmore |

| MEMBER | CHAIR | MEMBER |

| MEMBER | CHAIR | MEMBER | ||||||||||||||||||||||||

Ms. Siu |

| MEMBER | MEMBER |

| MEMBER | MEMBER | ||||||||||||||||||||||||||

Mr. Wessel | MEMBER | MEMBER | ||||||||||||||||||||||||||||||

Mr. Williams |

| MEMBER | CHAIR | MEMBER |

| MEMBER | CHAIR | MEMBER | MEMBER | |||||||||||||||||||||||

Number of Meetings in 2022 | 6 | 5 | 3 | 4 | 4 | 1 | ||||||||||||||||||||||||||

Mr. Wood |

| MEMBER | MEMBER | |||||||||||||||||||||||||||||

Number of Meetings in 2023 | 5 | 5 | 3 | 3 | 10 | 6 | 11 | |||||||||||||||||||||||||

| 1 | Mr. Kramer retired as Chairman of the Board, Chief Executive Officer and President of the Company effective as of January 29, 2024. Ms. Koellner was elected Chairman of the Board effective as of January 29, 2024. |

| 1 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||||||||

| Board Leadership Structure

|

Board Leadership Structure

Mr. Kramer serves as ourDuring 2023, the Board maintained a joint Chairman and Chief Executive Officer, and President and Ms. Koellner was elected bya separate independent Lead Director. When Mr. Kramer announced his retirement in late 2023, the independent membersBoard reviewed its leadership structure in connection with its succession planning activities. The Board ultimately decided to separate the roles of Chairman of the Board to serve as our independentof Directors and Chief Executive Officer, effective January 29, 2024, and elected Ms. Koellner, the former Lead Director, initially effective June 30, 2019 and subsequently each year thereafter.as Chairman of the Board. The Board believes that the current Boardthis leadership structure is the most appropriate for the Company and its shareholders at this time. The Board periodically reviewsdoes not have a specific policy with respect to separating or combining the roles of Chairman and Chief Executive Officer, or whether the Chairman should be an employee or non-employee director, and will continue to review the Board leadership structure in light of corporate governance standards, market practice and the roles of the ChairmanCompany’s specific needs and independent Lead Director, taking into consideration the views expressed by our shareholders.

In order to ensure that the independent and non-management members of the Board maintain proper oversight of management on behalf of our shareholders, the Board has an independent Lead Director who is elected annually by the independent members of the Board. The election of a Lead Director by the independent members of the Board demonstrates the Board’s continuing commitment to strong corporate governance, Board independence and the importance of the role of Lead Director.circumstances.

Currently, the Board believes that having Mr. KramerMs. Koellner serve as Chairman and Mr. Stewart serve as Chief Executive Officer and President best positions the Company to compete successfully and advance our shareholders’ interests. His extensiveWe believe this structure promotes active participation of the independent directors and strengthens the role of the Board in fulfilling its oversight responsibility while recognizing the day-to-day management direction provided by the Chief Executive Officer.

Ms. Koellner has served as a member of the Board since February 2015 and as Lead Director from June 30, 2019 through January 29, 2024, when she was elected Chairman of the Board. Ms. Koellner’s deep knowledge of the Company and the tire industry, gained through 23 years ofher significant board leadership and senior executive management experience, in positions of increasing authority including Chief Financial Officerextensive international business experience, as well as financial and President, North America,human resources experience, is valuable to the Board in hisher role as Chairman. Mr. Kramer has provided strong and open leadership of the Board as the Company executes its strategy in a highly competitive industry that continues to be challenged by volatile global economic conditions. The current combination of the Chairman and CEO roles enhances the Company’s ability to coordinate the development, articulation and execution of a unified strategy at both the Board and management levels. The Board also believes that having Mr. Kramer serve as Chairman and CEO has facilitated the flow of information to, and discussion among, members of the Board regarding the Company’s business.

The Governance Committee believes that Ms. Koellner is highly qualified to serve as our Lead DirectorChairman and that she provides strong leadership of the Board and the independent and non-management directors and diligently fulfills her duties as Lead Director.Chairman.

LEAD DIRECTORCHAIRMAN DUTIES

| • | Preside at all meetings of the Board, |

| • | Interact directly with all members of the Board and provide for the Board to fulfill its responsibilities effectively |

| • | Call meetings or executive sessions of the independent directors, and coordinate and develop the agenda for those meetings or sessions |

| • |

| Approve the schedule of Board meetings to ensure that there is sufficient time for discussion of all agenda items |

| • | Approve all information sent to the Board, including meeting agendas, and advise |

| • | Interview, along with the Chairman of the Governance Committee, all Board candidates and make recommendations to the Governance Committee and the Board |

| • | Discuss with the Governance Committee |

| • | Evaluate, together with the Compensation Committee, the |

| • | Assist the Governance Committee in connection with the annual Board and committee evaluation process, and address any issues regarding director performance |

| • | If requested by major shareholders, ensure that she is available for consultation and direct communication in appropriate circumstances |

| 2 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||||||||

| Board Leadership Structure

|

Additional duties of our independent Lead Director are set forth in Annex II to our Corporate Governance Guidelines.

In addition to the clearly-delineated and comprehensive oversight responsibilities of our Lead Director,independent Chairman of the Board, the other independent directors have ample opportunity to, and regularly do, assess the performance of the CEO and provide meaningful direction to him.

The Board has strong and effective independent oversight of management:

| • |

|

| • | All members of the Audit, Compensation and Governance Committees are independent directors; |

| • | Committee |

| • | Board and Committee agendas are prepared based on discussions with all directors and recommendations from management, and all directors are encouraged to request agenda items, additional information and/or modifications to schedules as they deem appropriate; and |

| • | The Board holds executive sessions of the independent directors at each Board meeting that are led by the |

The Board’s policy is that especially in our changing and challenging environment, it must retain the flexibility to determine the most effective Board leadership structure at any particular point in time. As a result, the Board has the responsibility to establish our leadership structure, including in connection with any CEO succession. Some of the factors that the Board has considered, and may consider in the future, in combining or separating the Chairman and CEO roles, include:

| • | The respective responsibilities of the |

| • | The effectiveness of the current Board leadership structure, including the Board’s assessment of the performance of the Chairman and CEO |

| • | Shareholder views on our Board leadership structure; |

| • | The Company’s operating and financial performance, including the potential impact of particular leadership structures on the Company’s performance; |

| • | The ability to attract or retain well-qualified candidates for the positions of CEO and Chairman of the |

| • | Practices at other similarly situated U.S. public companies; and |

| • | Legislative and regulatory developments. |

Board’s Role in Risk Oversight

Management continually monitors the material risks facing the Company, including competitive, strategic, operational, financial (accounting, liquidity and tax), legal, regulatory, cybersecurity, and environmental, social and governance risks. The Board as a whole has responsibility for oversight of management’s identification and management of, and planning for, those risks. Reviews of certain areas are conducted by relevant Board Committees that report their deliberations to the Board.

| ||||||||

|

|

The Board and its Committees oversee risks associated with their principal areas of focus, as summarized below. The Board and its Committees exercise their risk oversight function by carefully evaluating the reports they receive from management and

| 3 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||

| Board’s Role in Risk Oversight |

by making inquiries of management with respect to areas of particular interest to the Board. Board oversight of risk is enhanced by the fact that the Lead Director and Chairman attendattends virtually all Committee meetings and that Committee reports are provided to the full Board following each Committee meeting. We believe that our leadership structure also enhances the Board’s risk oversight function since our Lead DirectorChairman regularly discusses the material risks facing the Company with management. The ChairmanOur CEO, who is also a director, is expected to report candidly to his fellow directors on his assessment of the material risks we face, based upon the information he receives as part of his management responsibilities. Both the Lead DirectorThe Chairman and the ChairmanCEO are well-equipped to lead Board discussions on risk issues.

BOARD/COMMITTEE AREAS OF RISK OVERSIGHT

| Full Board | • Strategic, financial and execution risk associated with the annual operating plan and strategic plan (including allocation of capital investments)

• Major litigation and regulatory matters;

• Significant acquisitions and divestitures; and

• Management succession planning. | ||

| Audit Committee | • Risks associated with financial matters, particularly financial reporting and disclosure, accounting, and internal controls, | ||

| Human Capital and Compensation Committee | • Risks associated with the establishment and administration of executive compensation, incentive compensation programs, diversity and inclusion, and performance management of officers. | ||

| Governance Committee | • Risks associated with Board effectiveness and organization, corporate governance matters, and director succession planning. | ||

| Finance Committee | • Risks associated with liquidity, pension plans (including investment performance, asset allocation and funded status), tax strategies, currency and interest rate exposures, and insurance strategies. | ||

| Committee on Corporate Responsibility and Compliance | • Risks associated with health, safety and the environment, climate change, sustainability, product quality, and the Company’s legal and ethical compliance programs. | ||

| 4 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||||||||

| Management Succession Planning

|

Management Succession Planning

The Board of Directors considers the selection and retention of, and succession planning for, the Chief Executive Officer and other senior leaders to be one of its most important responsibilities. In accordance with our Corporate Governance Guidelines, the CEO delivers a report regarding succession planning with respect to the office of the Chief Executive Officer and other members of the executive management team on at least an annual basis. The Board then discusses management succession with the CEO, and during an executive session when the CEO is not present. These discussions include an evaluation of potential internal candidates for succession and identification of additional experience that candidates should gain to be ready to succeed in their proposed new roles. The Board also retains, from time to time, outside advisors to assist the Board in assessing our senior leadership and identifying developmental needs. As necessary, the Board also considers the need to recruit talent externally if internal candidates do not possess the requisite skills. In practice, these discussions often occur more frequently than annually, based on the Company’s needs at any particular time.

The Board also reviews, on an annual basis, talent across the entire organization, in particular diversity and how promotions and new hires supplement the diversity pool, focusing on what skill sets are needed for the that group to be successful. More frequent updates on progress against our goals are provided to the Human Capital and Compensation Committee (the “Compensation Committee”) in their meetings throughout the year. Associates who may become members of the executive team in the next five to ten years are provided exposure to the Board through presentations and other networking events.

An exampleExamples of the Board’s succession planning activities isare the recently announced leadership changes. Effective onIn November, Mr. Kramer finalized his plans to retire as Chairman, CEO and President of the Company. In connection with Mr. Kramer’s planned retirement, which was previously discussed with the Board as part of the Company’s ongoing and active succession planning process, the Board retained a leading executive search firm and conducted an extensive search, which considered both internal and external candidates for the CEO role. Ultimately, in January 1, 2023, Darren Wells2024, we named Mark W. Stewart as CEO and President. In addition, the position of Chairman of the Board was elected Executive Vice President and Chief Administrative Officer, a newly created position overseeingtransitioned from Mr. Kramer to Ms. Koellner, our strategy, business development, information technology and project management initiatives, and Christina Zamarro was promoted to succeed Mr. Wells as Executive Vice President and Chief Financial Officer. Prior to her promotion, Ms. Zamarro most recently served as Vice President, Finance and Treasurer.former independent Lead Director.

Consideration of Director Nominees

The Governance Committee will consider properly submitted shareholder nominations of candidates for membership on the Board as described below under “Identifying and Evaluating Nominees for Director.” In evaluating nominations, the Governance Committee seeks to address the criteria described below under “Director Selection Guidelines.”

Any shareholder desiring to submit a proposed candidate for consideration by the Governance Committee should send the name of the proposed candidate, together with biographical data and background information concerning the candidate, to the Office of the Secretary, The Goodyear Tire & Rubber Company, 200 Innovation Way, Akron, Ohio 44316-0001.

Director Selection Guidelines

The Board of Directors has approved guidelines for selecting directors as part of our Corporate Governance Guidelines. Criteria considered in the selection of directors include:

| • | Personal qualities and characteristics, including the highest personal and professional integrity, sound judgment, and reputation in the business community or a record of public service; |

| 5 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||||||||

| Director Selection Guidelines

|

| • | Substantial business experience or professional expertise and a record of accomplishments; |

| • | Experience and stature necessary to be highly effective, working with other members of the Board, in serving the long-term interests of shareholders; |

| • | Ability and willingness to devote sufficient time to the affairs of the Board and the Company and to carry out their duties effectively; |

| • | The needs of the Company at the time of nomination to the Board and the fit of a particular individual’s skills and personality with those of the other directors in building a Board that is effective and responsive to the needs of the Company; |

| • | Diverse business experience, substantive expertise, skills and background, as well as diversity in personal characteristics, such as age, gender and ethnicity; and |

| • | Ability to satisfy Goodyear’s and The Nasdaq Stock Market’s independence standards. |

Identifying and Evaluating Nominees for Director

The Governance Committee (in this section, the “Committee”) is responsible for identifying, screening and recommending persons for nomination to the Board. The Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and shareholders. On occasion, the Committee also retains third-party executive search firms to identify candidates. Under our prior master labor agreement with the United Steelworkers (the “USW”), the USW had the right to nominate a candidate for consideration for membership on the Board. Mr. Wessel, who became a director in December 2005, was identified and recommended by the USW. Ms. Clayton, whoMessrs. Hinrichs, Mitchell and Wood became directors in connection with a director in 2022, was identifiedcooperation agreement with Elliott Investment Management L.P. following an extensive and recommended by Ms. Koellner, our Lead Director.thoughtful search process.

Once a prospective nominee has been identified, the Committee makes an initial determination on whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the Committee with the recommendation of the prospective candidate, as well as the Committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board members and the likelihood that the prospective nominee can satisfy the director selection guidelines described above. If the Committee determines, in consultation with the Lead Director or non-executive Chairman of the Board the Lead Director and other Board members as appropriate, that additional consideration is warranted, it may request a third-party search firm to gather additional information about the prospective nominee’s background and experience and to report its findings to the Committee. The Committee then evaluates the prospective nominee against the standards and qualifications set out in Goodyear’s director selection guidelines. The Committee also considers such other relevant factors as it deems appropriate, including the balance of management and independent directors and the evaluations of other prospective nominees. The Committee seeks to have a diverse Board representing a range of backgrounds, knowledge and skills relevant to the Company’s business and the needs of the Board. We consider the members of our Board to have a diverse set of business and personal experiences, backgrounds and expertise, and to be diverse in terms of age, gender and ethnicity. These diversity characteristics are among the Board’s priorities when evaluating a pool of potential director candidates.

| 6 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||

| Identifying and Evaluating Nominees for Director |

In connection with this evaluation, the Committee determines whether to interview the prospective nominee, and if warranted, the Lead Director, the Chairman of the Committee, one or more other members of the Committee and others as appropriate,

| ||||||||

|

|

interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Committee makes a recommendation to the full Board as to the persons who should be nominated for election to the Board, and the Board makes its decision after considering the recommendation and report of the Committee.

DIRECTOR SKILL AND DIVERSITY MATRIX

Our Board is comprised ofnominees are committed, qualified individuals with a diverse and complementary blend of skills, business and personal experiences, backgrounds and expertise, including the following:

| Skills |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Public Company CEO/CFO |

|

|

|

|  |  |  |

|

|

|  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Public Company CEO/CFO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Public Company CEO/CFO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Public Company CEO/CFO |

|

|

|  |

|  |  |  |  |

|  |

|  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Financial Expert / M&A / Capital Markets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Financial Expert / M&A / Capital Markets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Financial Expert / M&A / Capital Markets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Financial Expert / M&A / Capital Markets |

|

|  |  |  |  |  |

|

|

|  |

|

|  |  |  |  |  |  |  |

|

|

|  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Industrial Manufacturing |  |  |

|  |  |  |  |

|

|

|  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Industrial Manufacturing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Industrial Manufacturing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Industrial Manufacturing |  |  |

|  |  |  |  |  |  |

|  |

|  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Automotive / Auto Supply Chain | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Automotive / Auto Supply Chain | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Automotive / Auto Supply Chain | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Automotive / Auto Supply Chain |

|

|

|

|  |  |

|

|

|

|  |

|

|

|  |

|  |  |

|  |

|  |

|  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Technology |  |

|

|

|

|  |

|

|  |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Technology | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Technology | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Technology |  |

|

|

|

|

|  |

|  |  |  |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

International | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

International | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

International | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

International |  |  |  |  |

|  |  |

|  |

|  |  |  |  |  |  |

|  |  |  |  |  |

|  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Marketing and Branded Consumer Products |

|

|  |

|

|

|

|

|  |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Marketing and Branded Consumer Products | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Marketing and Branded Consumer Products | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Marketing and Branded Consumer Products |

|

|  |  |

|

|

|

|

|  |  |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Business Model Transformation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Business Model Transformation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Business Model Transformation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Business Model Transformation |

|  |  |

|  |

|

|

|  |

|

|

|  |  |  |

|  |

|

|  |  |  |

|  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Legal / Regulatory |

|

|

|

|

|

|

|  |

|  |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Legal / Regulatory | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Legal / Regulatory | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Legal / Regulatory |

|

|

|

|

|

|

|

|

|

|

|  |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Demographics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Demographics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Demographics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Demographics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Age | 64 | 68 | 69 | 68 | 57 | 53 | 69 | 71 | 63 | 63 | 64 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Age | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Age | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Age | 65 | 69 | 70 | 57 | 69 | 58 | 54 | 70 | 60 | 64 | 56 | 64 | 61 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gender Diverse | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gender Diverse | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gender Diverse | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gender Diverse | F | M | M | F | F | M | M | M | F | M | M | F | M | M | M | F | F | M | M | M | F | M | M | M | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

African American |  |

|

|

|

|

|

|  |

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

African American | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

African American | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

African American |  |

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Asian | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Asian | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Asian | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Asian |

|

|

|

|

|  |

|

|  |

|

|

|

|

|

|

|

|  |

|

|  |

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

White |

|  |  |  |  |

|  |

|

|  |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

White | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

White | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

White |

|  |  |  |  |  |

|  |  |

|  |  |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LGBTQ+ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LGBTQ+ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LGBTQ+ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LGBTQ+ |

|

|

|

|

|

|

|

|

|

|  |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||||||||

| Identifying and Evaluating Nominees for Director

|

Public Company CEO/CFO | Directors who have served in senior leadership roles at large organizations provide us with a practical understanding of organizations, processes, strategy, risk management and other factors that promote growth. | |

Financial Expert/M&A/Capital Markets | An understanding of finance and accounting assists our directors in overseeing our financial reporting and internal controls to ensure they are accurate and transparent. | |

| Industrial Manufacturing | Directors with manufacturing experience provide valuable insight to management on the development and execution of our strategy. | |

Automotive / Auto Supply Chain | Directors with experience in automotive or the automotive supply chain provide valuable insight to management on our broader industry and the factors impacting it. | |

| Technology | Directors with expertise in technology provide valuable insight to management in developing advanced technologies that enable us to deliver superior products and services to our | |

| International | As a global company, we benefit from our directors who have experience with multinational companies or in international markets to help direct our global business plans and navigate challenges that we may encounter in our international operations. | |

Marketing and Branded Consumer Products | Marketing and branding initiatives are essential to our growth strategy to increase market share in a competitive industry. | |

Business Model Transformation | Directors who have enabled transformational growth help us consider how our products and services are delivered in the market as consumer preferences change over time. | |

| Legal/Regulatory | Directors with knowledge of the legal and regulatory framework in which we operate help evaluate risks and how our business may be impacted by governmental actions and public policy. | |

Board Structure and Committee Composition

As of the date of this Proxy Statement, Goodyear’s Board has twelvefifteen directors, each elected annually, and the following sixseven committees: (1) Audit, (2) Human Capital and Compensation, (3) Corporate Responsibility and Compliance, (4) Finance, (5) Governance, (6) Strategic and (6)Operational Review and (7) Executive. The current membership and the function of each of the committees are described below. Each of the committees operates under a written charter adopted by the Board, except for the Executive Committee which is provided for by our Code of Regulations. During 2022,2023, the Board held nine15 meetings. Each director attended at least 75% of all Board and applicable Committee meetings. Directors are expected to attend annual meetings of Goodyear’s shareholders. All of the directors who then served on the Board attended the last annual meeting of shareholders.

| 8 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||||||||

| Audit Committee

|

Audit Committee

MEMBERS:

Ms. Clayton

Mr. Geissler

Mr. Mahendra-Rajah

Mr. McGlade (Chairman)

Mr. Palmore

Mr. Wood MEETINGS IN

The Board has determined that each member of the Audit Committee is independent within the meaning of Goodyear’s independence standards and applicable Securities and Exchange Commission (“SEC”) rules and regulations, and Mr. Mahendra-Rajah, Mr. McGlade and Mr. | KEY RESPONSIBILITIES:

The Audit Committee assists the Board in fulfilling its responsibilities for oversight of the integrity of Goodyear’s financial statements, Goodyear’s compliance with legal and regulatory requirements related to financial reporting, the independent registered public accounting firm’s qualifications and independence, and the performance of Goodyear’s internal auditors and independent registered public accounting firm. The Audit Committee appoints, evaluates and determines the compensation of Goodyear’s independent registered public accounting firm; reviews and approves the scope of the annual audit plan; reviews and pre-approves all auditing services and permitted non-audit services (and related fees) to be performed by the independent registered public accounting firm; oversees investigations into complaints concerning financial matters; reviews policies and guidelines with respect to risk assessment and risk management, including Goodyear’s major financial risk exposures; oversees Goodyear’s information technology and cybersecurity strategy; prepares the Audit Committee report for inclusion in the annual proxy statement; oversees management’s design, implementation and operation of disclosure and internal controls over ESG reporting; and annually reviews the Audit Committee charter and the Committee’s performance. The Audit Committee works closely with management as well as Goodyear’s independent registered public accounting firm. The Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding from Goodyear for, outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

The report of the Audit Committee is on page |

Human Capital and Compensation Committee

MEMBERS: Mr. Firestone (Chairman)

Mr.

Ms. Koellner

Mr. Williams

MEETINGS IN

The Board has determined that each member of the Compensation Committee is independent within the meaning of Goodyear’s independence standards and applicable Nasdaq listing standards. | KEY RESPONSIBILITIES:

The Board of Directors has delegated to the Compensation Committee primary responsibility for establishing and administering Goodyear’s compensation programs for officers and other key personnel. The Compensation Committee oversees Goodyear’s compensation and benefit plans and policies for directors, officers and other key personnel, administers its incentive compensation plans (including reviewing and approving grants to officers and other key personnel), and reviews and approves annually all compensation decisions relating to officers, including the Chief Executive Officer. The Compensation Committee also prepares a report on executive compensation for inclusion in the annual proxy statement, reviews and discusses the Compensation Discussion and Analysis with management and recommends its inclusion in the annual proxy statement, and periodically reviews our diversity and inclusion strategies and progress. The report of the Compensation Committee is on page

In performing its duties, the Compensation Committee meets periodically with the CEO to review compensation policies and specific levels of compensation paid to officers and other key personnel, and reports and makes recommendations to the Board regarding executive compensation policies and plans. The Compensation Committee informs the non-management directors of the Board of its decisions regarding compensation for the CEO and |

| 9 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||||||||

| Human Capital and Compensation Committee

|

Human Capital and Compensation Committee (continued)

other significant decisions related to the administration of its duties. The Compensation Committee also will consider the results of shareholder advisory votes on executive compensation matters and the changes, if any, to Goodyear’s executive compensation policies, practices and plans that may be warranted as a result of any such vote and reviews an annual risk assessment of Goodyear’s executive compensation policies, practices and plans as part of its role in overseeing management’s identification and management of, and planning for, compensation-related risks. Under its charter, the Compensation Committee may delegate its authority to one or more of its members as appropriate.

The Compensation Committee has the authority to retain outside advisors, including independent compensation consultants, to assist it in evaluating actual and proposed compensation for officers. The Compensation Committee also has the authority to approve, and receive appropriate funding from Goodyear for, any such outside advisor’s fees. Prior to retaining any such advisors, the Compensation Committee considers the independence-related factors identified in applicable securities laws and Nasdaq listing standards. During |

Committee on Corporate Responsibility and Compliance

MEMBERS:

Ms. Clayton Mr. Hinrichs

Mr. Mahendra-Rajah

Mr. Palmore (Chairman)

Ms. Siu

Mr. Wessel

MEETINGS IN | KEY RESPONSIBILITIES:

The Committee on Corporate Responsibility and Compliance reviews Goodyear’s legal and ethical compliance programs as well as its business conduct policies and practices and its policies and practices regarding its relationships with shareholders, employees, customers, governmental agencies and the general public. The Committee monitors Goodyear’s objectives, policies, programs and performance with respect to environmental, social and governance (ESG) matters, including its climate strategy, sustainability initiatives, and compliance with environmental laws and regulations. The Committee also monitors Goodyear’s objectives, policies, programs and performance with respect to workplace health and safety and product quality. The Committee may recommend appropriate new policies to the Board of Directors. |

| 10 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||||||||

| Finance Committee

|

Finance Committee

MEMBERS:

Mr. Firestone

Mr. Geissler

Ms. Lewis Mr. Mitchell

Ms. Siu

MEETINGS IN | KEY RESPONSIBILITIES:

The Finance Committee consults with management and makes recommendations to the Board of Directors regarding Goodyear’s capital structure, dividend policy, tax strategies, compliance with terms in financing arrangements, insurance strategies, banking arrangements and lines of credit, pension plan funding, and significant mergers and acquisitions and other business development activities. The Finance Committee also reviews and consults with management regarding policies with respect to interest rate and foreign exchange risk, liquidity management, counterparty risk, derivative usage, credit ratings, and investor relations activities. |

Governance Committee

MEMBERS:

Ms. Koellner

Ms. Lewis

Mr. McGlade

Mr. Williams (Chairman)

MEETINGS IN

The Board has determined that each member of the Governance Committee is independent within the meaning of Goodyear’s independence standards. | KEY RESPONSIBILITIES:

The Governance Committee identifies, evaluates and recommends to the Board of Directors candidates for election to the Board. The Governance Committee also develops and recommends appropriate corporate governance guidelines, recommends policies and standards for evaluating the overall effectiveness of the Board of Directors in the governance of Goodyear and undertakes such other activities as may be delegated to it from time to time by the Board of Directors. The Governance Committee also makes recommendations to the Board of Directors regarding the composition, organization, structure and operations of the Board and its committees, including the leadership structure of the Board and separating or consolidating the positions of Chairman and Chief Executive Officer. |

Strategic and Operational Review Committee

MEMBERS: Mr. Firestone Mr. Kramer (Chairman) Mr. Mitchell Mr. Williams Mr. Wood MEETINGS IN 2023: 6 | KEY RESPONSIBILITIES: The Strategic and Operational Review Committee (the “Review Committee”) is an advisory committee established in 2023 to oversee and support the Board and management’s review of various strategic and operational alternatives that may be available to the Company to maximize the long-term value of the Company. The Review Committee’s work culminated in the development of the Goodyear Forward transformation plan that was shared with investors on November 15, 2023. |

| 11 |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||

| Executive Committee |

Executive Committee

MEMBERS:

Mr. Firestone

Ms. Koellner

Mr. Kramer

Ms. Lewis

Mr. McGlade

Mr. Palmore

Mr. Williams

MEETINGS IN | KEY RESPONSIBILITIES:

The Executive Committee is comprised of the During 2023, the Executive Committee met frequently to discuss succession planning activities related to the search for a new CEO. |

| |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | ||||||||

| Corporate Responsibility

|

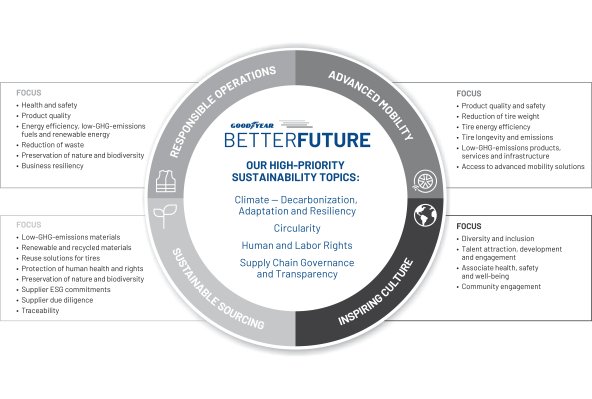

Corporate Responsibility

In 2022,2023, we reinforcedcontinued to further our commitment to corporate responsibility. Corporate responsibility is an integral part of our business strategy and operations.how we work. We are committed to ethical and sustainable practices to protect the planet and people; give back to the community; provide a safe, diverse, and healthy workplace; and engage our associates in these efforts.